February 2026 turned out to be a positive month for Escorts Kubota Limited — which includes Farmtrac, Powertrac, Kubota, and Adico tractor brands — as the company reported strong year-on-year growth in tractor sales. Escorts Kubota sold 10,339 tractors during the month, compared to 8,590 units in February 2025, registering

VST Tillers Tractors Ltd delivered an impressive sales performance in February 2026, selling a total of 4,435 units, including 3,963 power tillers and 472 tractors. Compared to February 2025, the company recorded significant growth, reflecting rising demand for agricultural machinery and improving momentum in India’s farm mechanisation sector. Both power

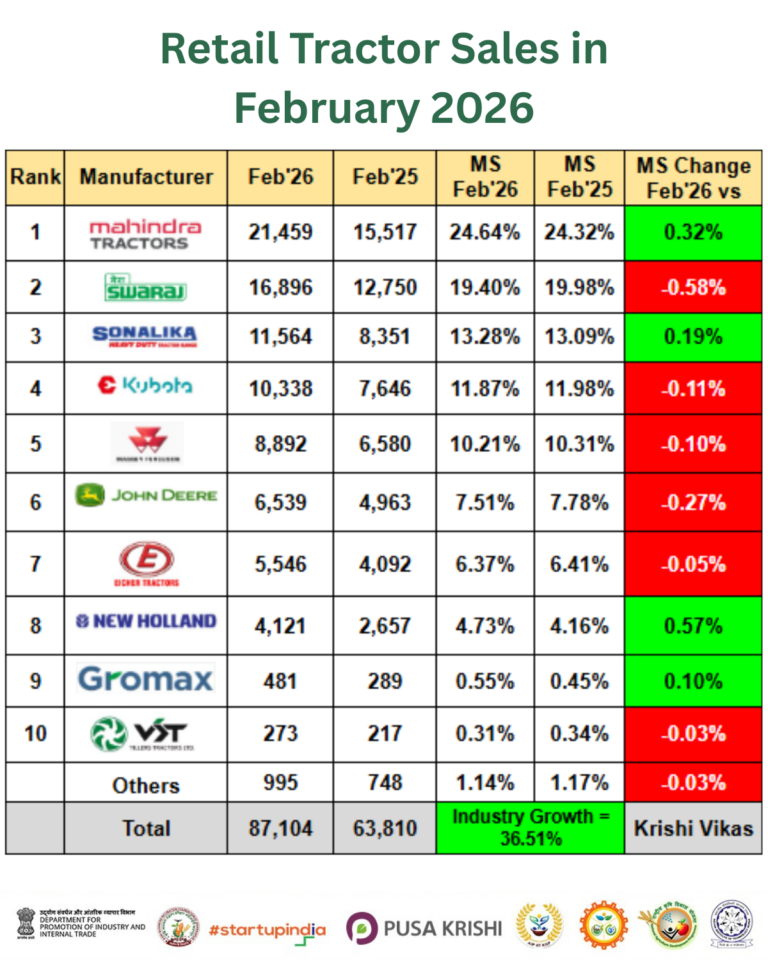

India’s retail tractor market witnessed impressive growth in February 2026, with total sales reaching 87,104 units, compared to 63,810 units in February 2025. This marks a significant 36.51% year-on-year increase, reflecting stronger rural liquidity, better crop earnings, and consistent replacement demand across major agricultural regions. Alongside higher sales volumes, the

Tractors completely transformed farming practices. In earlier times, farmers depended heavily on manual labor and animal power to carry out essential tasks. Activities like ploughing fields, sowing seeds, and transporting harvests required immense effort and consumed valuable time, often affecting productivity. With the arrival of tractors, farms gained access to

When preparing your field for planting, choosing the right type of reversible plough is highly necessary. Both mechanical and hydraulic reversible ploughs help turn the soil and make seedbeds, but they differ significantly in how they work, cost, and ease of use. What Is a Mechanical Reversible Plough? A mechanical

Escorts Kubota Limited delivered a strong start to 2026 with noteworthy tractor sales in January. The company reported selling 9,799 tractors during the month, which is a considerable increase compared to 6,669 units sold in January 202, representing about 47% year-on-year growth. Domestic Market Growth Most of the growth came