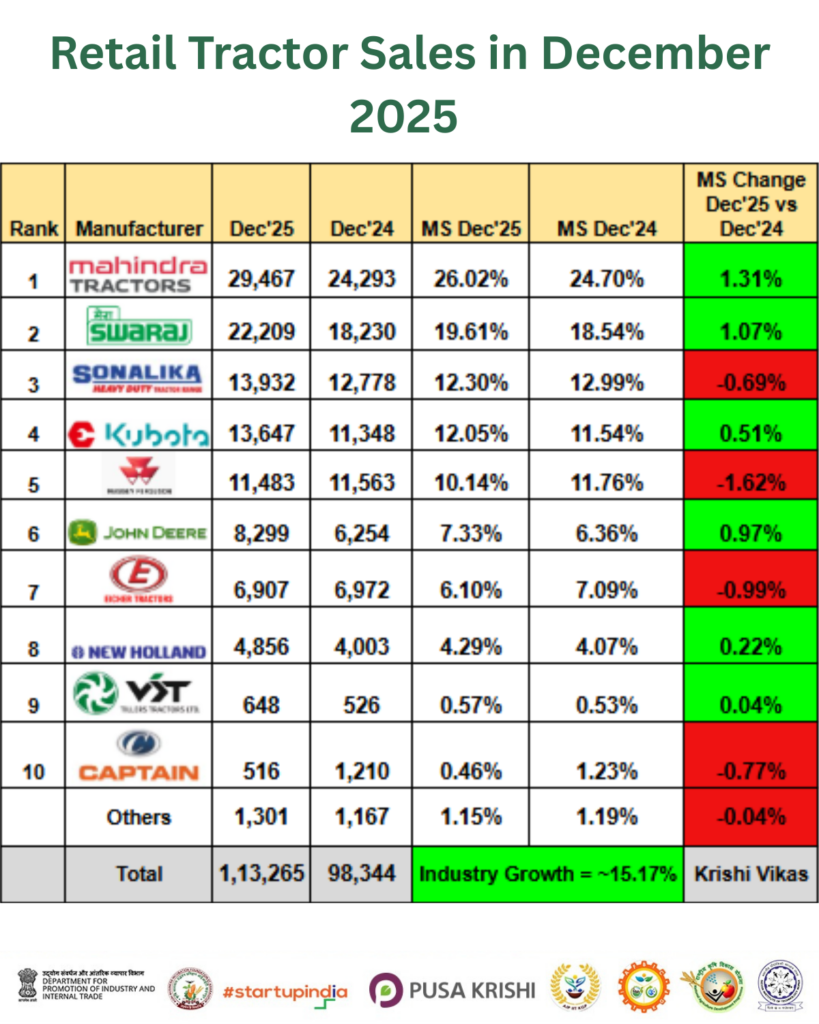

A massive 25.78% surge in the Tractor sales segment in December 2024. Know the brand-wise performance and sales contribution here.

The Indian tractor market wrapped up 2024 on a high note, recording an impressive 25.78% increase in retail sales for December 2024 compared to December 2023. According to the tractor sales report published by FADA, an impressive 99,292 units were sold during the month, underscoring the sector’s resilience and the growing demand for agricultural machinery in the country.

Let’s dive into the detailed brand-wise performance and what it signifies for the tractor industry.

Mahindra Farm Equipment Sector:

According to the Mahindra tractor sales report, the company emerged as the frontrunner, selling 24,289 tractors in December 2024, a notable 30.68% increase from 18,586 units sold in December 2023. This growth also translated into a 0.92% boost in its market share.

However, On the export front, 924 tractors were sold this year compared to 1,110 last year, reflecting a slight dip in international demand but reinforcing Mahindra’s global presence.

As India’s leading tractor manufacturer, Mahindra’s performance reflects its robust market presence and consistent product demand.

Swaraj Tractors

Swaraj Tractor, a division of Mahindra & Mahindra, demonstrated commendable growth, selling 18,226 units in December 2024. This marks a 26.71% increase from 14,384 units in December 2023. The company also saw a slight rise in market share, up by 0.14%, cementing its role as a key player in the tractor segment.

TAFE Limited

TAFE Limited achieved the highest percentage growth among major players, with a staggering 43.38% increase in sales, according to the FADA tractor sales report.

The company sold 11,555 units in December 2024 compared to 8,059 units in December 2023. This performance boosted TAFE’s market share by 1.43%, showcasing its ability to capture the rising demand effectively.

International Tractors Limited (ITL)

ITL sold 12,766 tractors in December 2024, up 12.48% from the 11,350 units sold in December 2023.

Despite this steady growth, the company’s market share dipped by 1.52%, indicating intensified competition in the sector.

Escorts Kubota Limited

Escorts Kubota Limited recorded a 13.38% growth, selling 9,252 units in December 2024 compared to 8,160 units in December 2023.

However, the company experienced a 1.02% drop in market share, reflecting the dynamic nature of the industry.

Other Notable Performances

Eicher sold 6,971 units in December 2024, a 23.47% increase from 5,646 units in December 2023. Despite this growth, its market share slightly declined by 0.13%.

John Deere achieved a 21.46% sales growth with 6,351 units sold in December 2024. The market share dropped by 0.22%, suggesting stiff competition.

Kubota Tractor faced a 2.30% decline in sales, with 1,488 units sold compared to 1,523 units in

December 2023. Its market share was reduced by 0.43%.

Other Brands on the Rise

The FADA tractor sales report showcased a remarkable 63.84% collective growth of other brands, selling 4,340 units in December 2024 compared to 2,649 units in December 2023.

This led to a 1.01% increase in market share, highlighting the growing acceptance of emerging players.

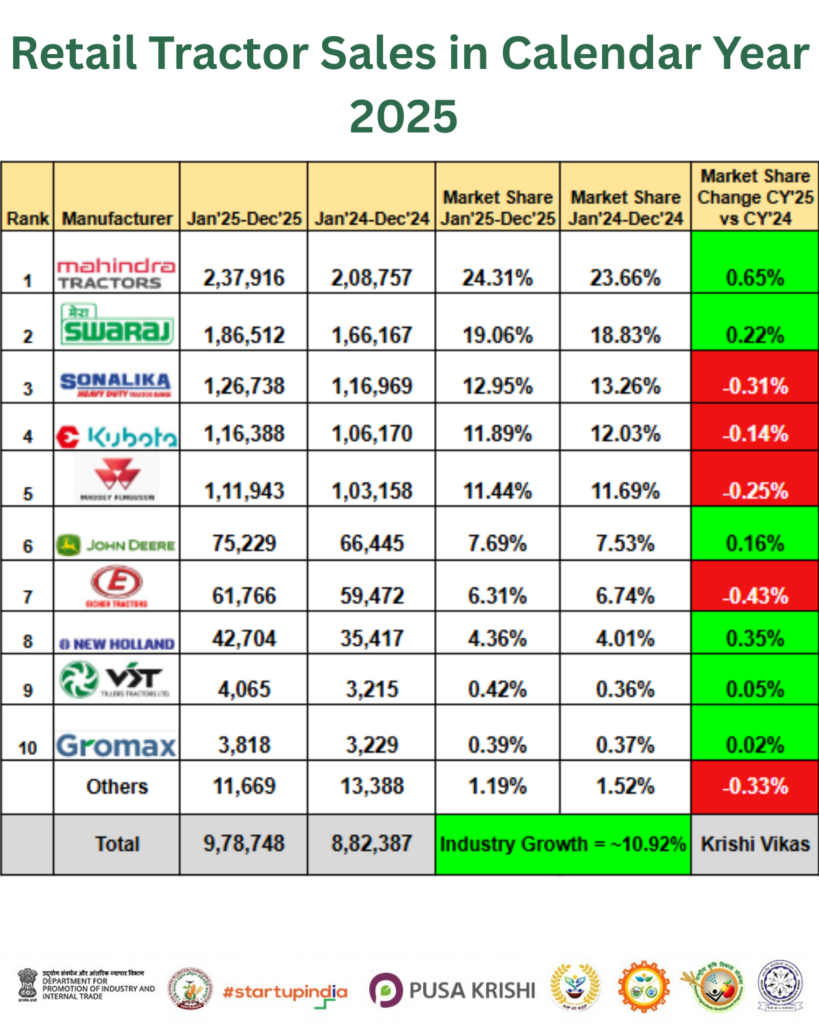

Conclusion: A Promising Outlook for 2025

The 25.78% rise in tractor sales in December 2024 paints a positive picture for the Indian agricultural machinery market.

While established brands like Mahindra, Swaraj, and TAFE continue to dominate, the performance of smaller players signals healthy competition and innovation in the sector.

With increased mechanization in farming and supportive government policies, the Indian tractor market is poised for sustained growth in 2025 and beyond.

Stay Tuned with Krishi Vikas to get more insights from the Industry!