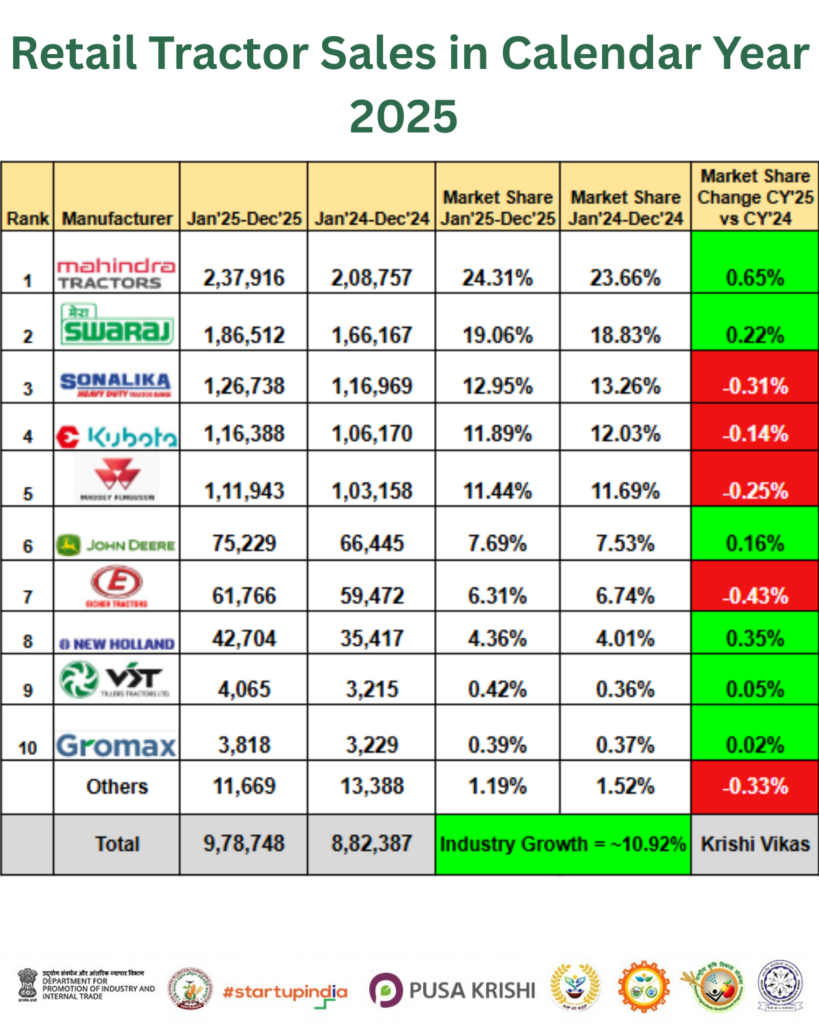

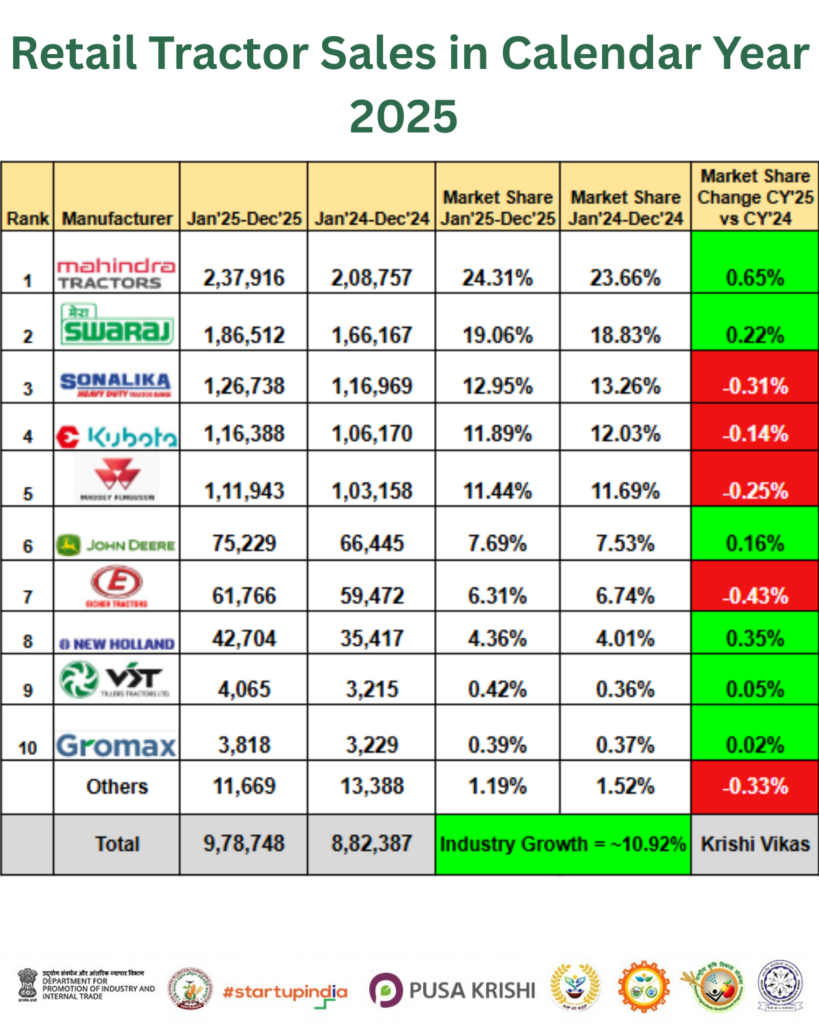

India’s tractor market posted a solid showing in 2025, with retail volumes rising to 978,748 units, up from 8,82,387 units in the previous year. This represents a year-on-year increase of 10.92%, taking the industry close to the landmark figure of one million tractors sold in a single year.

Several factors contributed to this upward trend, including a reduction in GST on tractors, continued policy emphasis on agriculture, increased efforts by manufacturers, and consistent demand from non-farm applications such as construction and transport. Balanced inventory management at the dealer level further helped maintain steady retail momentum throughout the year.

Analysing 2025 retail tractor sales

Mahindra retained its leadership in the Indian tractor market during CY 2025, registering retail sales of 2,37,916 units, up from 2,08,757 units in CY 2024. The brand also strengthened its position, with market share rising from 23.66% to 24.31%.

Swaraj delivered steady growth, selling 1,86,512 tractors in CY 2025 compared to 1,66,167 units a year earlier. Its market share saw a marginal improvement, increasing from 18.83% to 19.06%, reflecting consistent demand.

Sonalika recorded retail volumes of 1,26,738 units in CY 2025, higher than the 1,16,969 units sold in CY 2024. However, its market share experienced a slight dip, moving from 13.26% to 12.95%.

Escorts Kubota posted retail sales of 1,16,388 units in CY 2025, compared with 1,06,170 units in the previous year. Despite higher volumes, its market share eased marginally from 12.03% to 11.89%.

Massey Ferguson also reported growth in retail sales, reaching 1,11,943 units in CY 2025 versus 1,03,158 units in CY 2024. Its market share declined slightly from 11.69% to 11.44%.

Collectively, the top five tractor manufacturers accounted for 7,79,497 units sold in CY 2025, representing approximately 79.64% of the total retail tractor volume of 9,78,748 units.

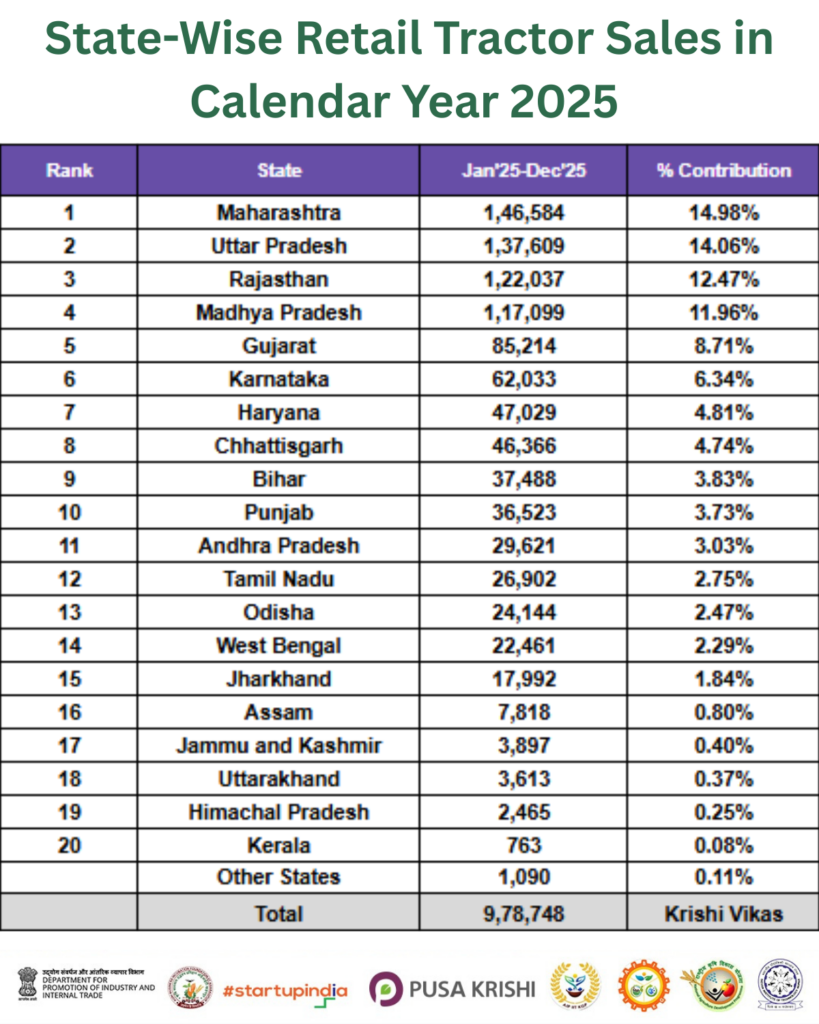

Analysing 2025 state-wise tractor sales

Maharashtra led the country as the largest tractor market in CY 2025, recording retail sales of 1,46,584 units and accounting for 14.98% of total nationwide volumes. The state’s strong performance was supported by active agricultural operations along with steady demand from non-farm applications.

Uttar Pradesh ranked second, with retail sales reaching 1,37,609 units, contributing approximately 14.06% of overall tractor sales. Ongoing demand from small and marginal farmers remained a key driver for the state.

Rajasthan reported retail volumes of 1,22,037 units during CY 2025, representing about 12.47% of total sales. Extensive farming activity and continued use of tractors for haulage helped sustain its position among the top markets.

Madhya Pradesh followed with sales of 1,17,099 units, translating to a market share of nearly 11.96%. Increasing levels of farm mechanization and supportive government initiatives contributed to consistent demand.

Gujarat completed the top five states, selling 85,214 tractors and accounting for 8.71% of total retail volumes. The state continued to gain from diversified cropping patterns and well-developed rural infrastructure.

Together, the top five states accounted for combined retail sales of 6,08,543 tractors in CY 2025, contributing close to 62.18% of the overall industry volume of 9,78,748 units.

Future of retail tractor sales

In 2026, it could be expected that tractor demand could experience temporary softness following the rollout of TREM V emission norms for tractors below 50 HP. In the absence of any deadline extension, higher acquisition costs may prompt buyers to postpone purchase decisions.

On the other hand, an extension of the implementation timeline could enable the industry to scale new highs, with total tractor sales potentially touching around 10.5 lakh units. Additionally, the phased entry of electric and CNG-powered tractors is likely to create fresh growth avenues, especially in non-farm applications such as construction and haulage.

Summing up

2025 proved to be a robust phase for the Indian tractor industry, as retail volumes rose by 10.92% to reach 9,78,748 units. This growth was underpinned by sustained government support for agriculture, a reduction in GST, proactive efforts by manufacturers, and consistent demand from non-agricultural segments.

While regulatory changes may create near-term challenges, the industry’s long-term prospects remain encouraging. Continued policy support, technological advancements, and the widening application of tractors across sectors beyond farming are expected to drive steady and sustainable growth in the years ahead.