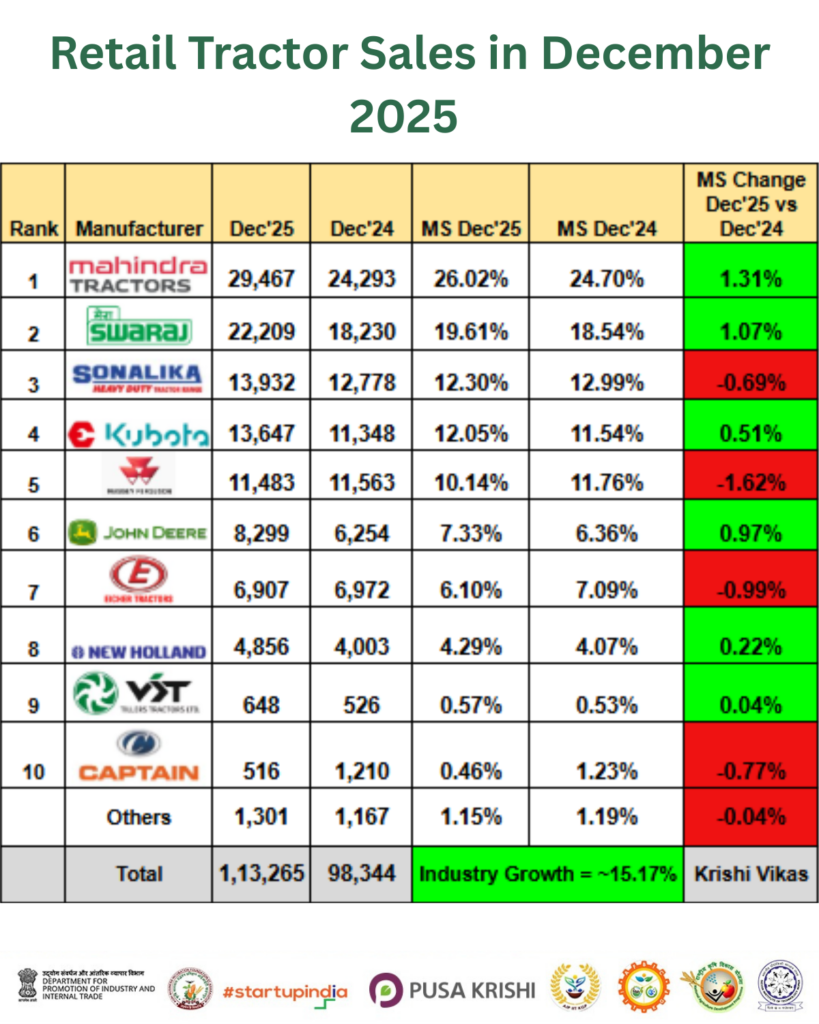

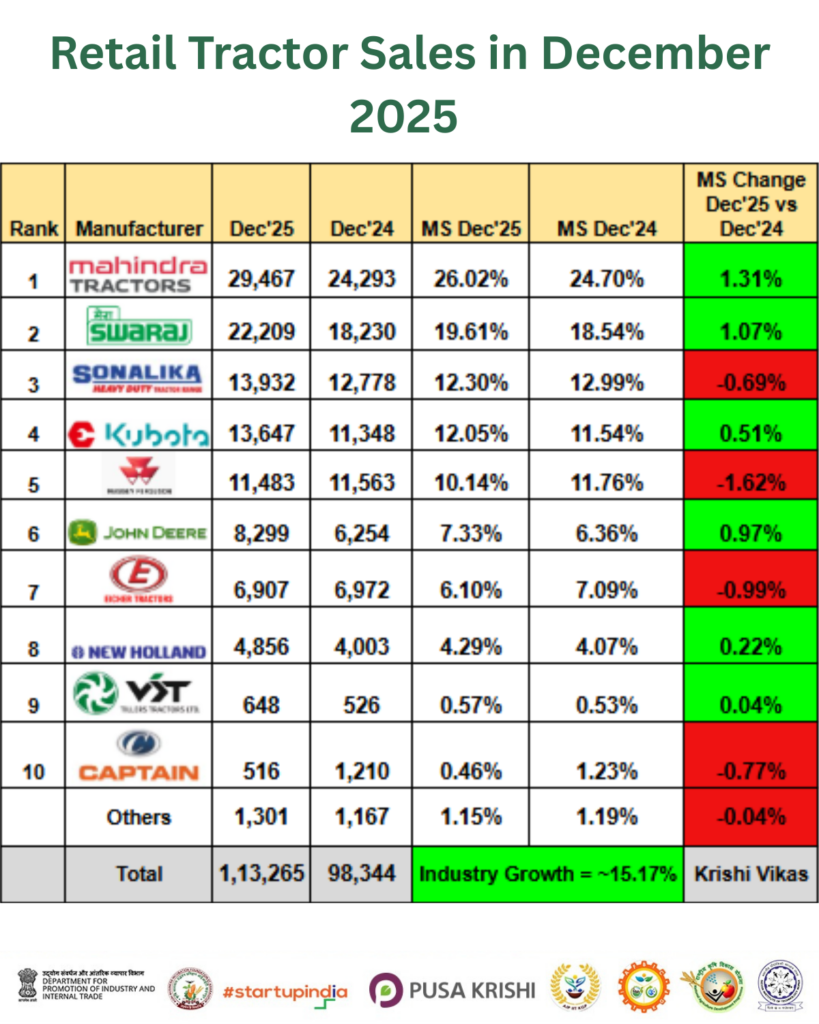

India’s tractor retail market closed December 2025 on a positive note, recording sales of 1,13,265 units compared to 98,344 units in December 2024. This translates into a robust year-on-year growth of 15.17%, reflecting sustained buying interest across multiple regions. The performance highlights healthy rural sentiment and steady demand momentum. This article reviews tractor retail performance for December 2025 and the year-to-date period from April to December 2025, while analysing how leading manufacturers contributed to overall growth.

Brand-wise Retail Tractor Performance: December 2025

Mahindra continued to lead the tractor retail market in December 2025, posting sales of 29,467 units, an increase from 24,293 units in the same month last year. Its market share rose from 24.70% to 26.02%, further strengthening its position at the top.

Swaraj maintained its upward trajectory, retailing 22,209 tractors in December 2025 versus 18,230 units in December 2024. The brand’s market share improved from 18.54% to 19.61%, indicating sustained demand in major farming belts.

Sonalika reported retail volumes of 13,932 units during the month, compared to 12,778 units a year earlier. Despite higher sales, its market share eased slightly from 12.99% to 12.30%.

Escorts Kubota recorded December 2025 sales of 13,647 units, up from 11,348 units in December 2024. Its market share increased from 11.54% to 12.05%, supported by steady performance across both utility and premium tractor categories.

Massey Ferguson sold 11,483 tractors in December 2025, marginally lower than the 11,563 units sold in December 2024. As a result, its market share declined from 11.76% to 10.14%, reflecting increased competition in the mid-horsepower segment.

Collectively, the top five tractor manufacturers sold 90,738 units in December 2025 out of the total industry volume of 1,13,265 units. This represents around 80.11% of monthly retail sales, underlining the highly concentrated nature of the Indian tractor market.

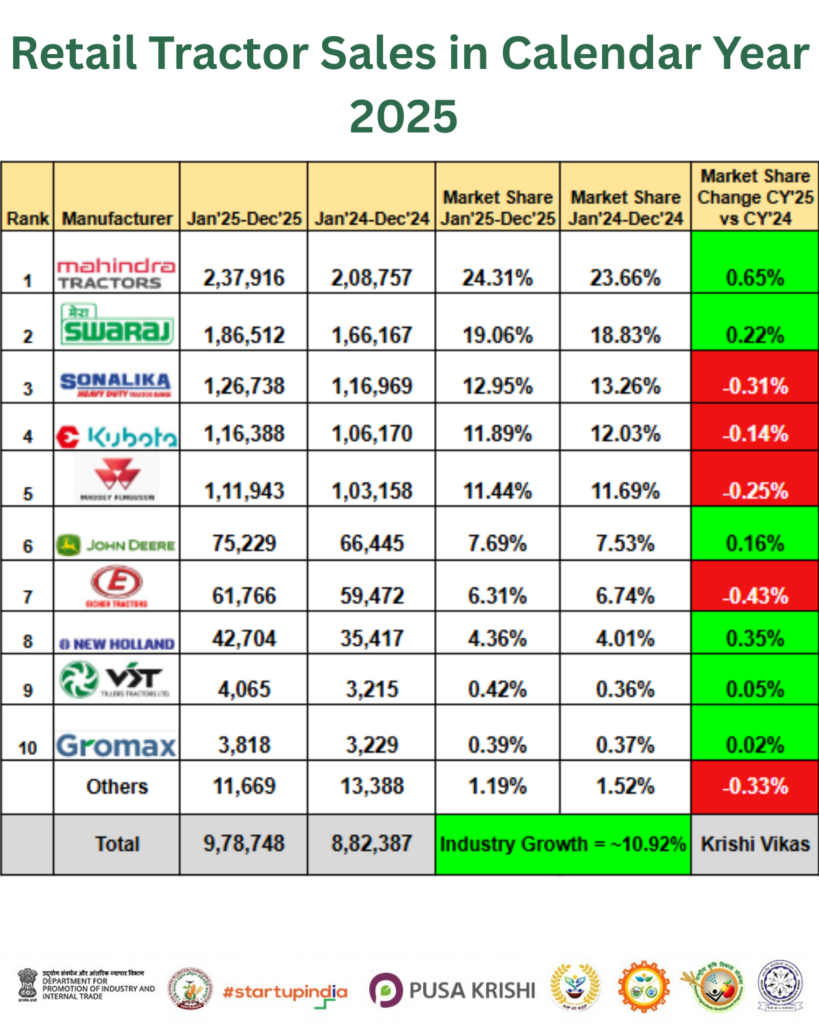

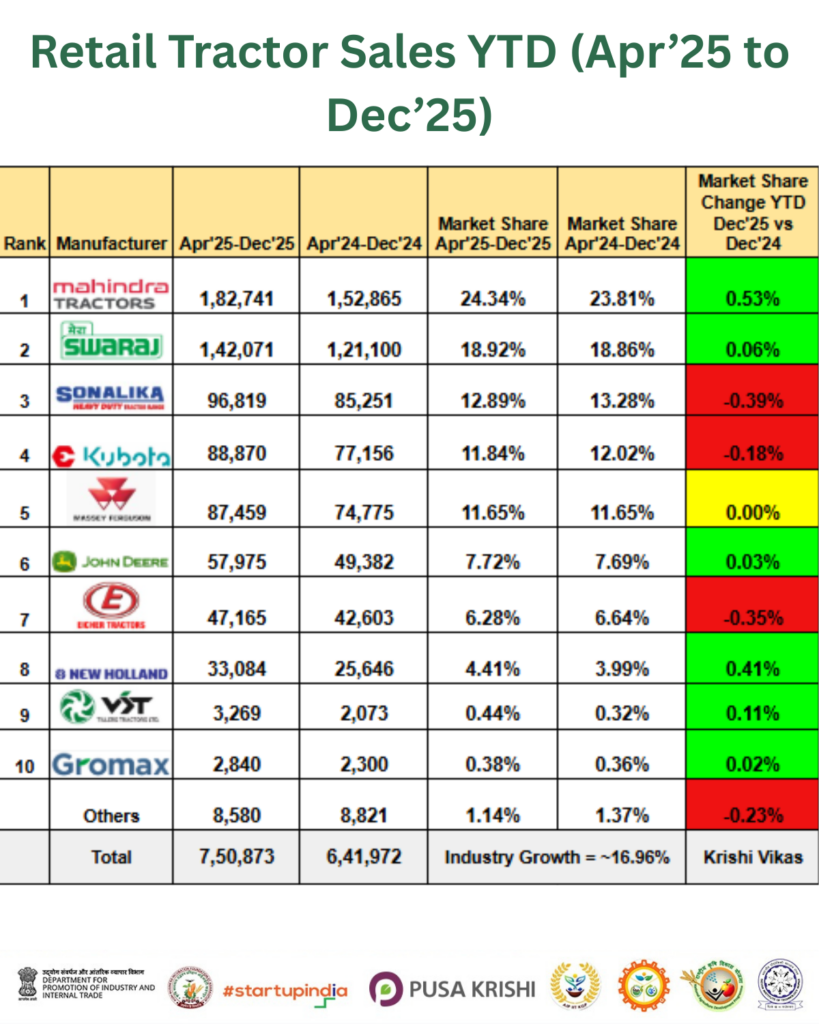

Year-to-Date Tractor Retail Performance (April–December 2025)

On a year-to-date basis, Mahindra retained its leadership with retail sales of 1,82,741 units during April–December 2025, compared to 1,52,865 units in the same period last year. Its market share increased from 23.81% to 24.34%, reinforcing its dominant position.

Swaraj recorded YTD sales of 1,42,071 tractors, up from 1,21,100 units in the previous year. The brand saw a marginal improvement in market share from 18.86% to 18.92%, reflecting consistent performance.

Sonalika posted year-to-date retail volumes of 96,819 units compared to 85,251 units last year. However, its market share declined slightly from 13.28% to 12.89%.

Escorts Kubota achieved YTD sales of 88,870 units during April–December 2025, rising from 77,156 units in the same period of 2024. Despite higher volumes, its market share edged down from 12.02% to 11.84%.

Massey Ferguson sold 87,459 tractors during the April–December 2025 period, an increase from 74,775 units last year. The brand maintained a stable market share of 11.65%, demonstrating resilience amid growing competition.

In total, the top five tractor brands together accounted for 5,97,960 units out of the overall industry retail volume of 7,50,873 tractors during April–December 2025. This translates to a combined share of approximately 79.64%, highlighting their continued dominance in the market.

Conclusion

The retail tractor sales performance in December 2025, along with strong year-to-date numbers for April–December 2025, clearly indicates sustained growth in India’s tractor industry. The continuation of double-digit growth reflects improving rural confidence and stable demand across regions. With this momentum, the industry enters the next quarter on a solid footing, supported by strong brand performance and positive market sentiment.