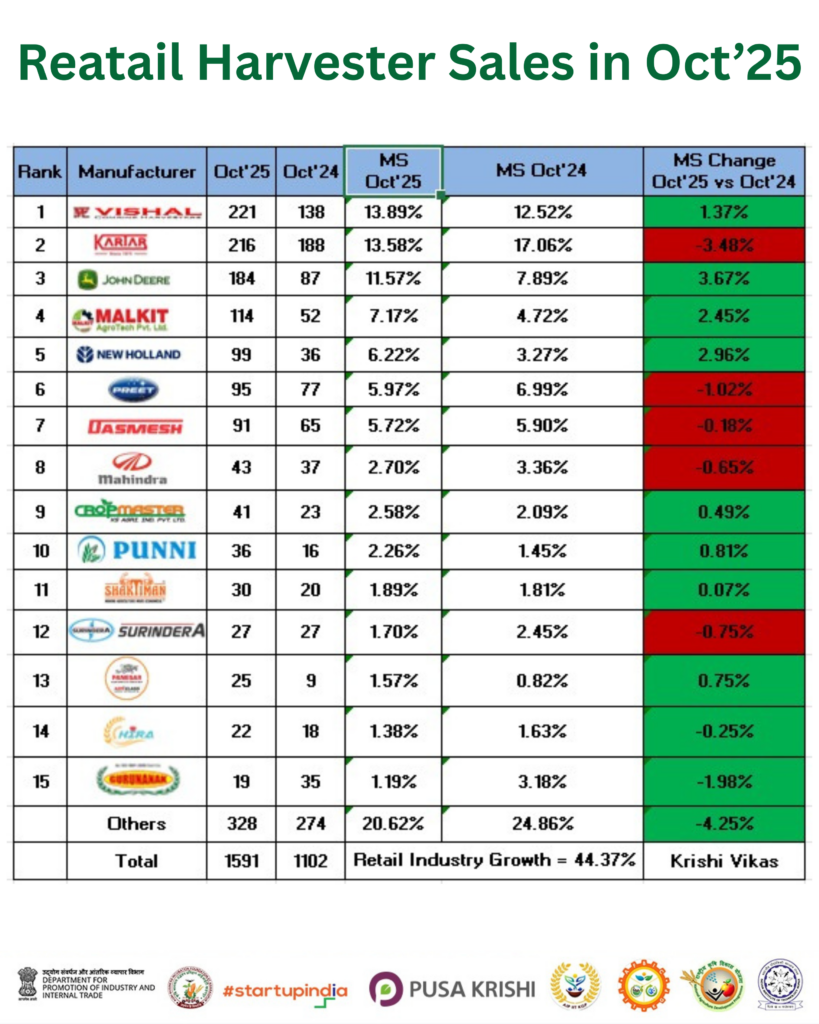

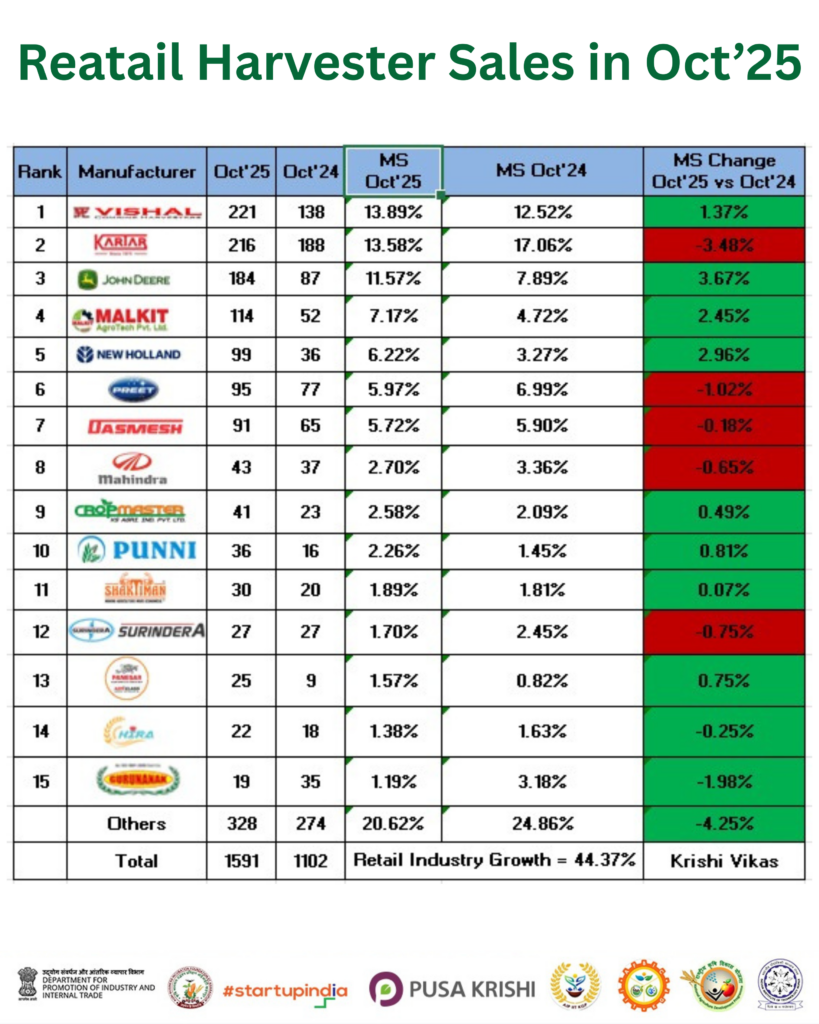

India’s harvester market saw strong growth in October 2025, with 1,591 total units sold compared to 1,102 units in October 2024. This 44.37% year-on-year rise highlights the rise in machine use in the farming sector and as well as the high demand for farming equipment during the season of harvesting.

India’s Harvester Market Grows Sharply in October 2025

In October 2025, the harvester market saw strong performances from the top five brands compared to last year. Vishal maintained its leadership position, selling 221 units, up from 138 units a year ago — a 60.14% growth. Its market share also rose from 12.52% to 13.89%, keeping it at the top of the list. Kartar followed with 216 units sold this October against 188 units last year, showing a 14.89% increase, though its market share dipped from 17.42% to 13.58%.

On the other hand, John Deere registered impressive growth, selling 184 units compared to 87 units in October 2024 — a jump of 111.49% — and lifted its market share from 7.89% to 11.57%. Malkit nearly doubled its performance with 114 units sold, up from 52 units last year, reflecting a 119.23% rise and an improved market share of 7.17%. New Holland also performed strongly, selling 99 units this year against 36 units in the same period last year, marking a 175% increase and pushing its market share higher by 2.96%.

Together, these five brands — Vishal, Kartar, John Deere, Malkit, and New Holland — sold 830 harvesters out of the total 1,591 units sold across India in October 2025, capturing a dominant 52.17% of the market.

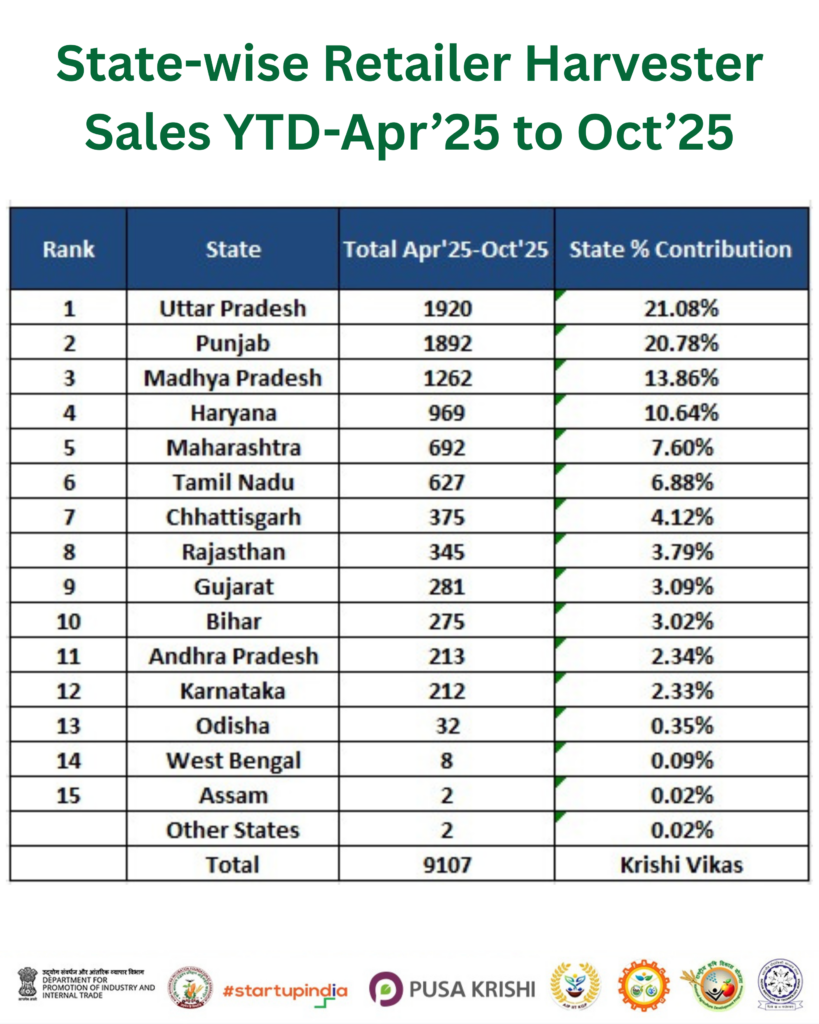

YTD Retail Harvester Sales by State (Apr–Oct 2025)

- Uttar Pradesh led the harvester market with 1,920 units sold, making up 21.08% of India’s total sales.

- Punjab followed closely with 1,892 units, securing a solid 20.78% share of the national market.

- Madhya Pradesh took the third spot with 1,262 units sold, contributing 13.86% to the country’s total.

- Haryana added 969 units to overall sales, holding a 10.64% share of the Indian harvester market.

- Maharashtra reported 692 units sold, representing 7.6% of the total harvester sales across India.

Summing up

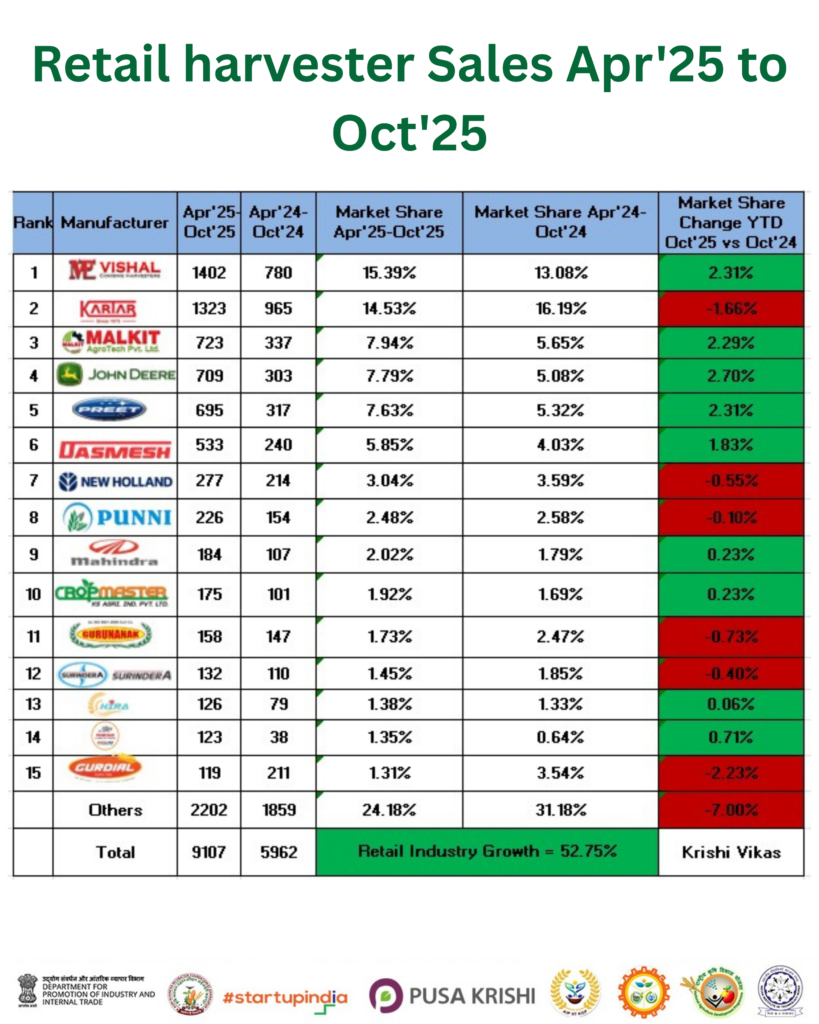

The Indian harvester market recorded strong growth, rising by 44.37% in October 2025 and 52.75% between April and October 2025. With this steady progress, the industry is set to reach new milestones in the upcoming Rabi season. Stay tuned as India’s farm mechanisation journey continues to gain power and pace!