Retail tractor sales witnessed a strong upswing in November 2025, touching 1,24,340 units, sharply higher than 79,557 units sold in the same month last year. This reflects a powerful 56.29% YoY expansion, driven by improved farmer sentiment, a healthy outlook for the rabi season, and overall stronger demand across key markets.

Retail Tractor Sales – November 2025 Overview

Market movement in November showed notable shifts among leading brands. Mahindra remained the frontrunner with 31,925 units, rising from 19,517 units last year and gaining 1.14% market share. Swaraj followed close behind at 23,220 units, recording steady progress with a marginal 0.20% share gain.

Sonalika also grew from 10,856 to 15,741 units, but its market share dropped by 0.99%, suggesting heightened competition despite volume gains. Escorts Kubota reported 15,202 units, adding 0.94% to its share, indicating stronger retail traction. Meanwhile, Massey Ferguson clocked 13,557 units, though its share slipped by 0.89%.

Together, the top five brands contributed 99,645 units—over 80% of total November 2025 retail sales.

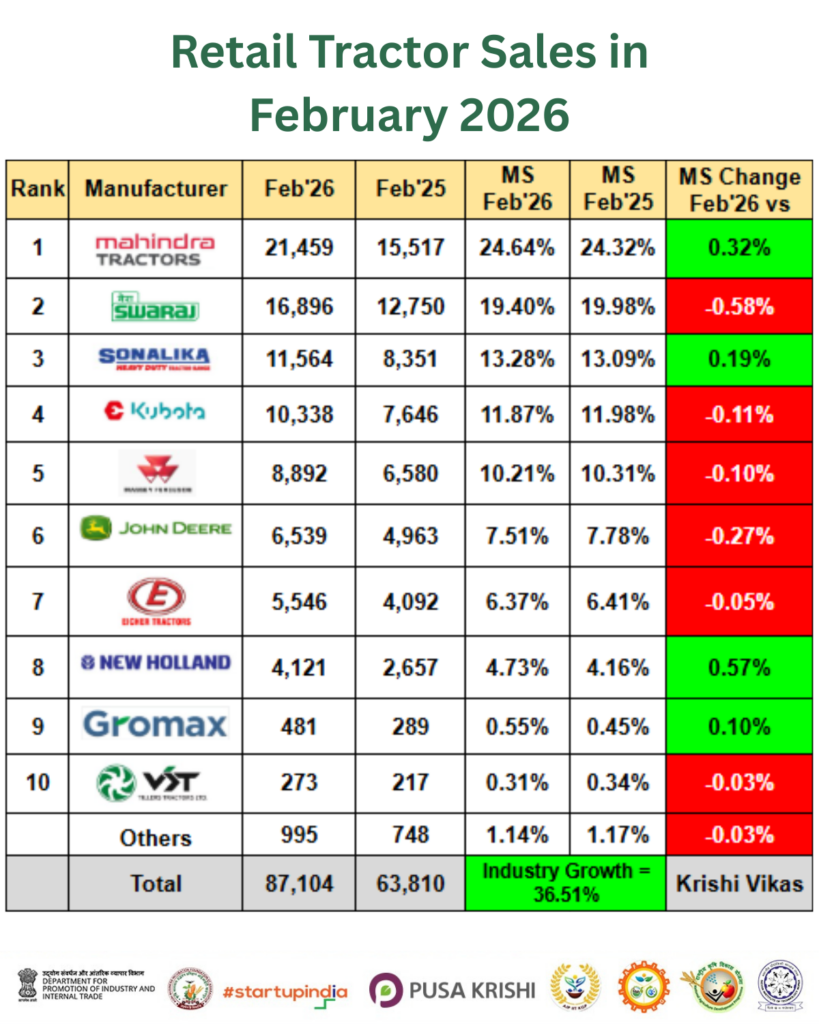

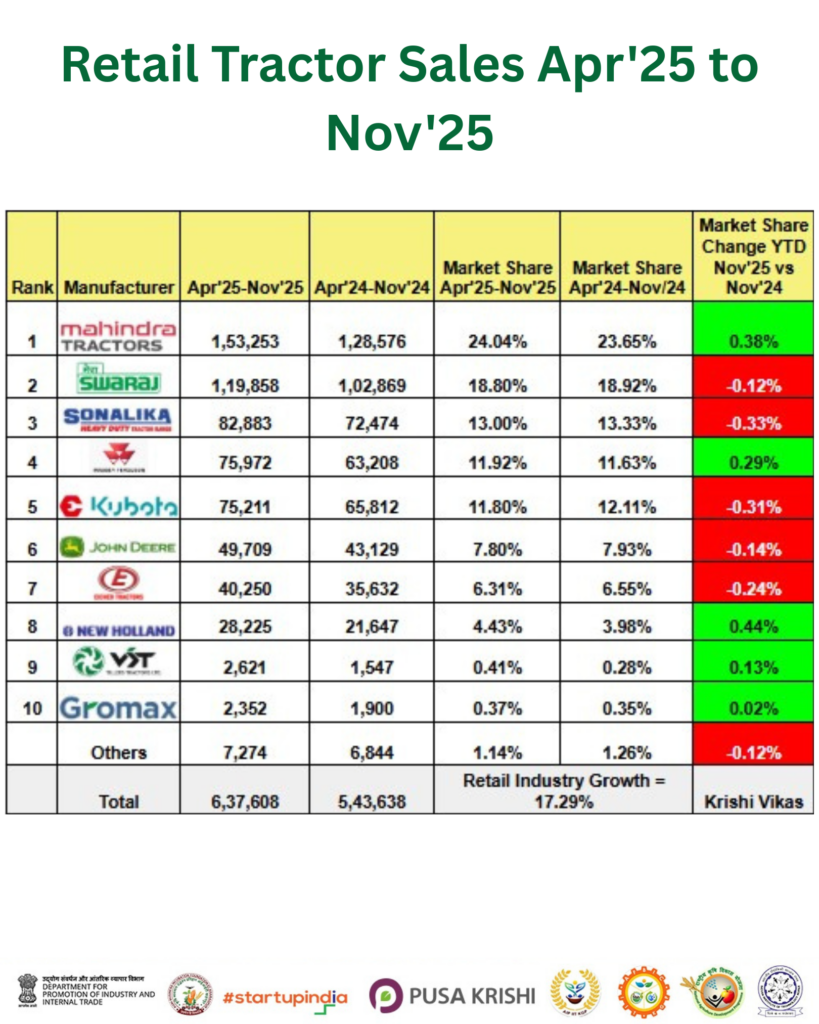

YTD Retail Tractor Sales (April 2025 – November 2025)

Mahindra dominated the YTD chart at 1,53,253 units, improving from 1,28,576, and securing a 0.38% increase in market share.

Swaraj posted 1,19,858 units, up from 1,02,869, though its market share eased by 0.12% due to stiffer competition in key HP segments.

Sonalika, with 82,883 units compared to 72,474 earlier, also saw a 0.33% decline in share.

Massey Ferguson improved to 75,972 units from 63,208, gaining 0.29% share.

Escorts Kubota reached 75,211 units, ahead of last year’s 65,812, but witnessed a 0.31% drop in market share.

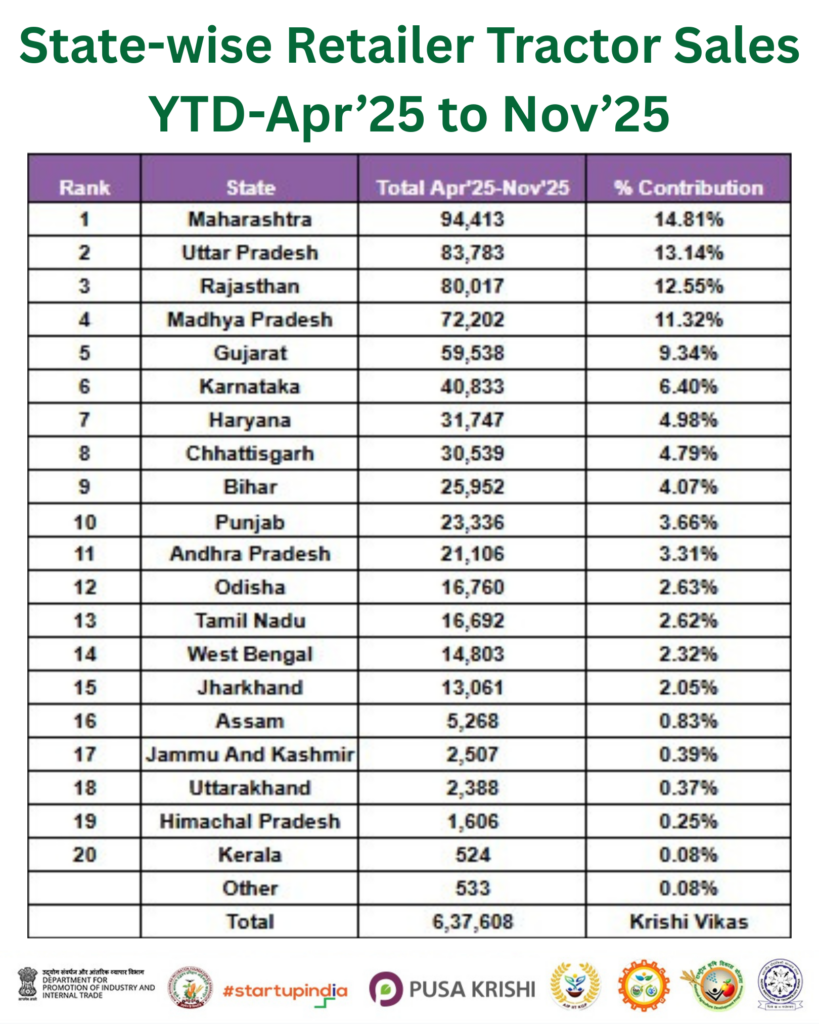

State-Wise YTD Sales (April–November 2025)

Maharashtra led the nation with 94,413 units, contributing 14.81% to India’s total retail sales. Strong mechanization trends and a successful Kharif season drove demand.

Uttar Pradesh followed with 83,783 units (13.14% share), maintaining its position as a high-demand market due to its extensive agricultural base.

Rajasthan recorded 80,017 units (12.55% share), supported by favourable monsoon patterns and increased wheat sowing.

Madhya Pradesh delivered 72,202 units (11.32% share), while Gujarat contributed 59,538 units (9.34% share).

The top five states together sold 389,953 units, making up 61.16% of India’s total YTD retail volume of 6,37,608 units.

Conclusion

The retail tractor industry continues to move on a strong upward path, both in November 2025 and throughout the April–November period. While overall sales momentum has improved sharply, individual brand market shares reveal a dynamic and competitive landscape. Major agricultural states—especially Maharashtra, Uttar Pradesh, and Rajasthan—remain pivotal drivers of national tractor demand.