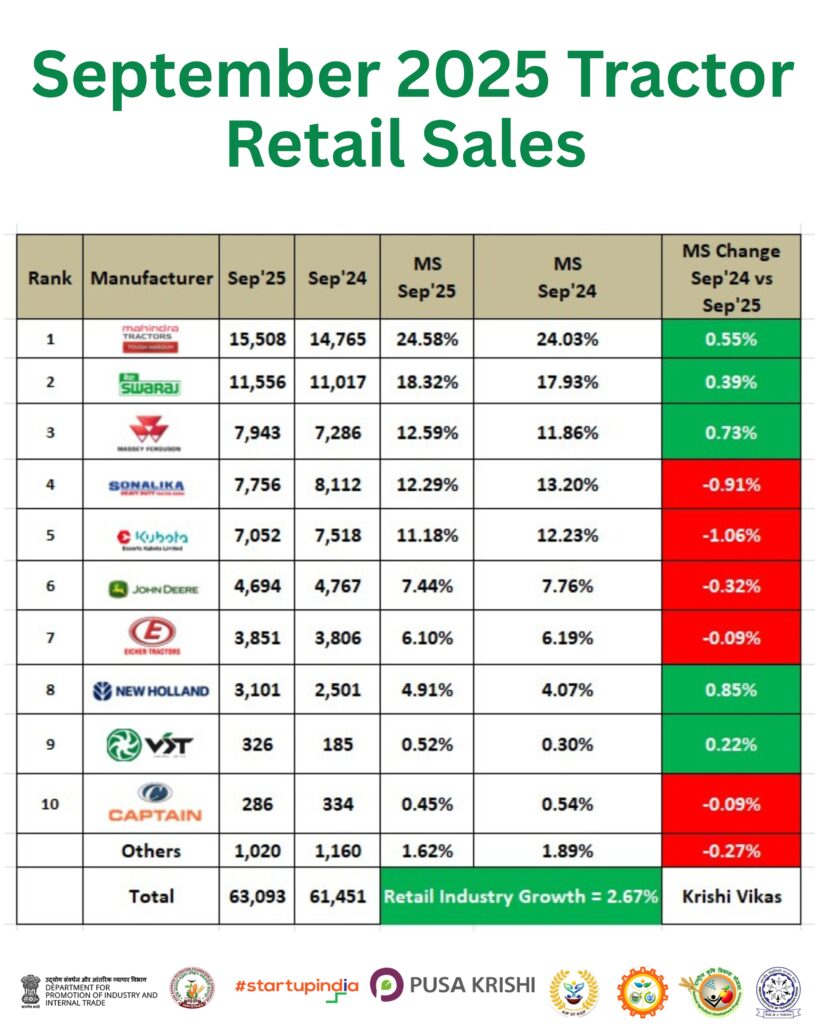

The retail tractor industry in September 2025 recorded sales of 63,093 units, showing a 2.67% year-on-year increase. Although the growth looks modest, two key factors played a role — the onset of Navratri festivities and the implementation of the new GST reform in the last week of September. Both events caused delays in registrations, which are likely to spill over into October. This indicates that October 2025 may witness a sharper jump in sales figures, reflecting these pending registrations.

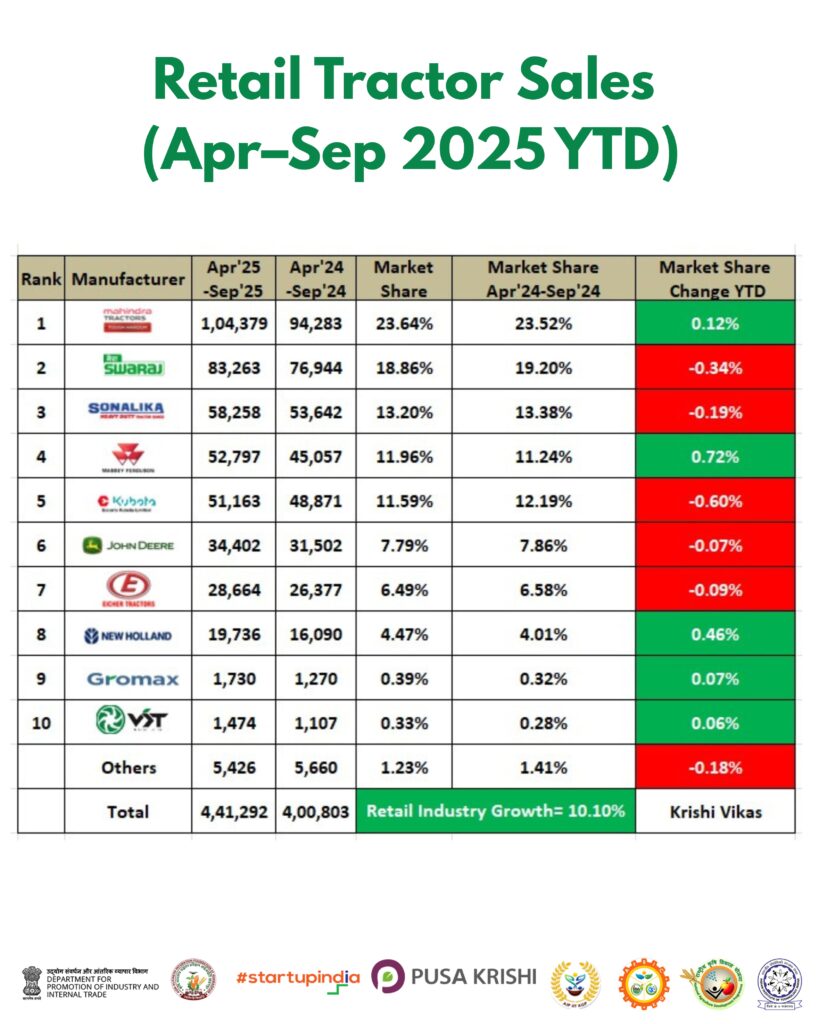

In this blog, we’ll explore September’s sales performance, year-to-date (Apr–Sep 2025) trends, and a state-wise breakdown to understand how the tractor industry and leading brands are performing.

Market Overview – September 2025

September kept the tractor market on a growth track, though the pace was tempered by external factors. The industry’s total retail sales rose from 61,451 units in September 2024 to 63,093 units in September 2025.

This consistent performance highlights two key points:

- Steady demand continues to drive tractor sales, supported by agriculture and rural markets.

- Festive and policy influences can temporarily affect numbers, but usually balance out in the following month.

With October including both pending registrations and festive demand peaks, the outlook remains upbeat.

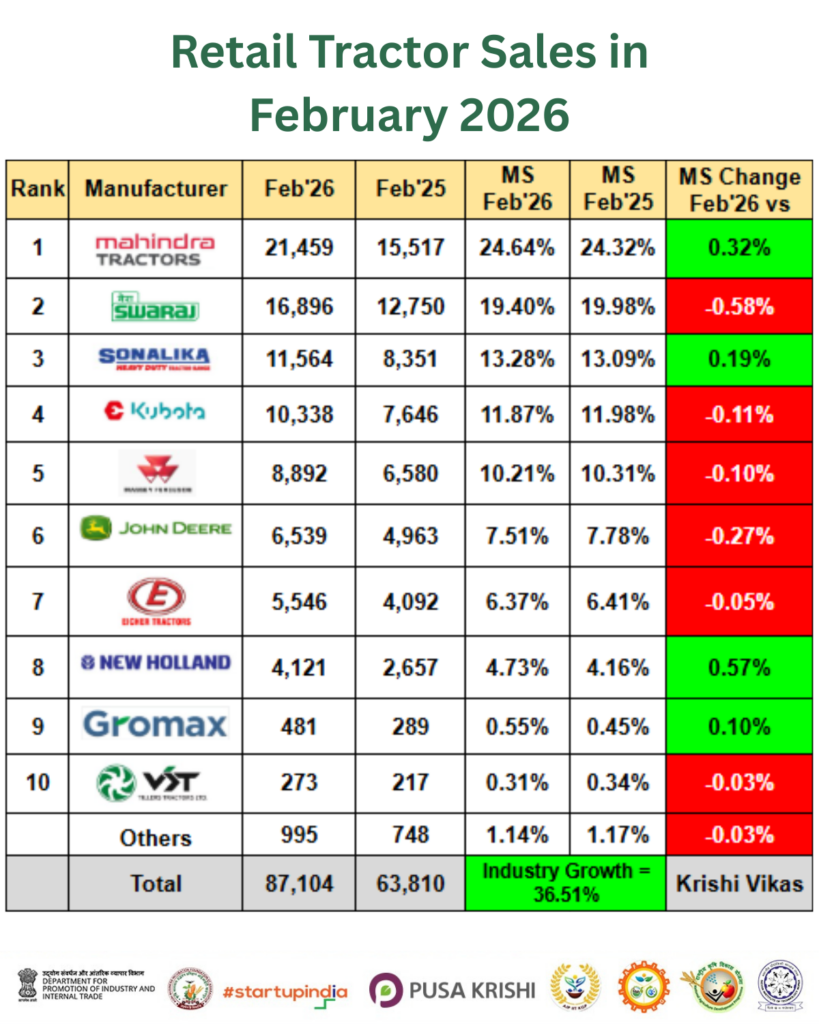

Tractor Sales Highlights – September 2025

The market continued to show resilience in September, with mixed performances among major players:

- Mahindra Tractors sold 15,508 units, rising from 14,765 units a year ago. That’s a 5.03% YoY growth and a 0.55% increase in market share.

- Swaraj Tractors recorded 11,556 units, compared to 11,017 in September 2024, marking a 4.89% growth and a 0.39% MS gain.

- Massey Ferguson performed strongly with 7,943 units, up from 7,286 last year, delivering a 9.02% YoY growth and a 0.73% market share rise.

- Sonalika Tractors saw a dip, selling 7,756 units versus 8,112 units in 2024, a 4.39% decline, which resulted in a 0.91% MS drop.

- Escorts Kubota also faced pressure, posting 7,052 units against 7,518 in the same period last year.

The tractor market in September 2025 may have appeared steady rather than spectacular, but the fundamentals remain strong. With 63,093 tractors sold and a 2.67% growth rate, the industry is well-positioned for an upbeat October that could reveal the true strength of demand. Together, Mahindra, Swaraj, Massey Ferguson, Sonalika, and Escorts Kubota accounted for over 78% of total tractor sales in September 2025, highlighting their strong hold on the market.